The Cardano price has jumped by nearly 200% from its lowest level in 2024, helped by the rising odds that the Securities and Exchange Commission (SEC) will approve a spot ADA ETF. ADA was trading at $0.80 on Friday morning, giving it a market cap of over $28 billion. Here are the top three reasons to sell Cardano.

ADA price is severely overvalued

The first main reason to sell Cardano is that it is one of the most overvalued tokens in the cryptocurrency industry.

Sure, it is hard to find the real value of a cryptocurrency since most of them have no utility. However, comparing Cardano and other similar coins shows no reason why ADA deserves a $28 billion valuation.

For example, Binance Coin and Solana have market caps of $93 billion and $88 billion, respectively. While these are huge numbers, at least one can see what these networks do. For example, DEX networks in the two blockchains have handled over $2.2 trillion in volume combined. They also have hundreds of dApps in the ecosystem.

Cardano, on the other hand, has a $28 billion valuation and little to show for it. Its DEX protocols have handled $4.5 billion in volume cumulatively, much less than other smaller chains such as Starknet, Near, and Fantom.

Cardano is largely a ghost chain

Another reason to consider selling ADA is that it is largely a ghost chain or a blockchain without an ecosystem. One of the best ways to assess whether a layer-1 network is a ghost chain is to visit DeFi Llama and CoinGecko and research its ecosystem.

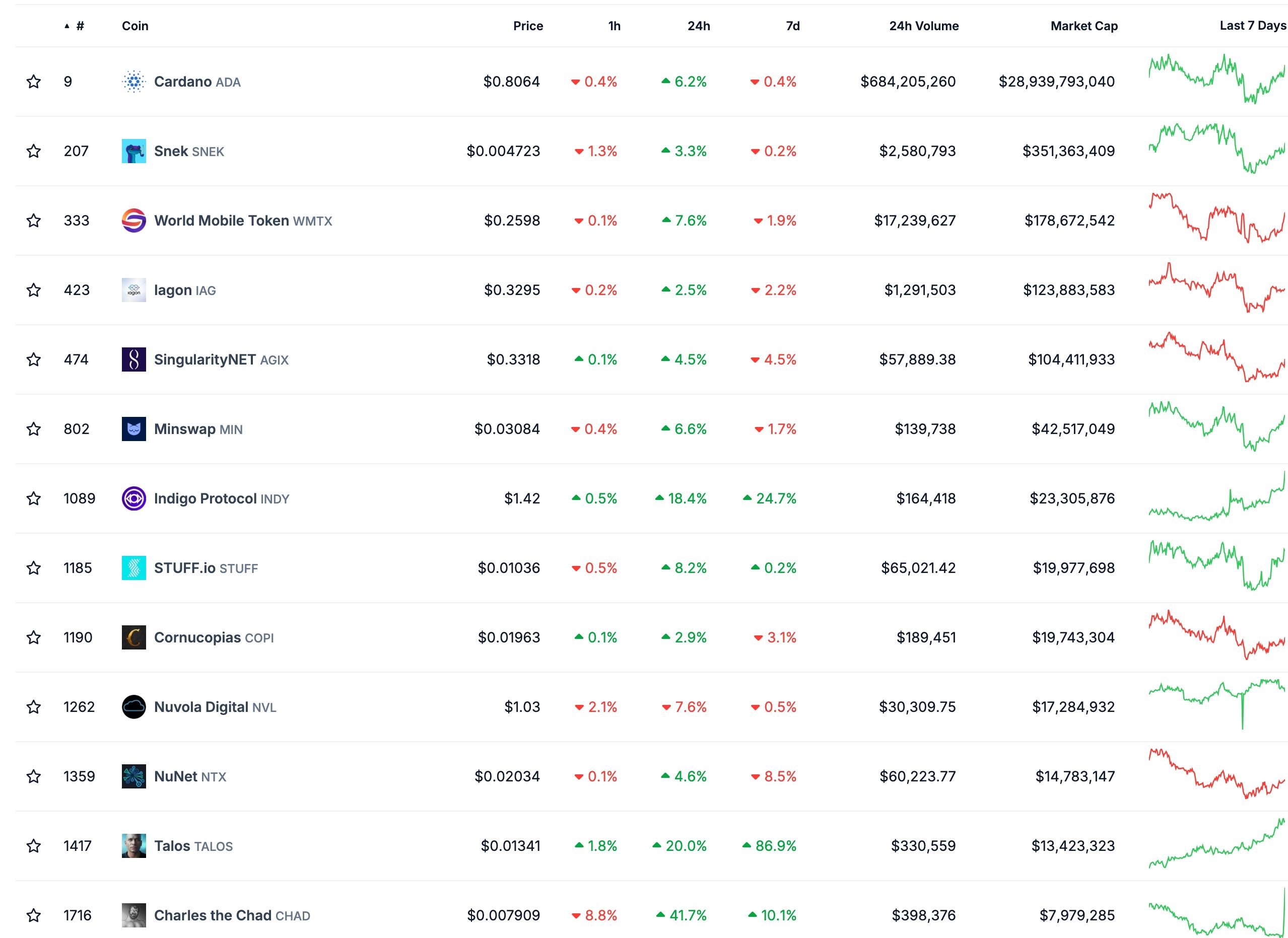

The screenshot below lists the largest Cardano tokens by market cap. Most of them are largely unknown players in the crypto industry.

A look at DeFi Llama shows that Cardano has just 40 dApps in its ecosystem and a total value locked of $387 million. This figure makes Cardano much smaller than other players in the crypto industry, such as Sonic, Core, and Zircuit.

The biggest players in the Cardano ecosystem are Liqwid, Minswap, Indigo, Splash Protocol, and Lenfi. All these are fairly small blockchains with negligible market share in the crypto industry.

Potential Cardano price catalysts may disappoint

Further, the Cardano price has some potential catalysts that explain its 200% surge. However, these catalysts may not be enough to push ADA higher in the long term.

First, Charles Hoskinson has a VIP dinner on March 1st that may lead to a major partnership. While this is good, Cardano has a long history of not fulfilling promises. One of the best examples was its announcement that it would move Ethiopia’s education system to the blockchain in 2021. Nothing has happened since then.

Second, the Cardano price has soared amid the hope that the SEC will approve a spot ADA ETF. However, approval does not guarantee that investors will be interested in it.

Ethereum, whose ETFs have struggled to gain traction, is a good example of this. The Ethereum price is at the same level as when the SEC approved its ETFs in September.

Third, the announced BitcoinOS integration and Midnight scaling solutions may not be enough catalysts for the Cardano price.

READ MORE: