Following a vibrant debut in December with huge crypto acquisitions, Donald Trump’s World Liberty Financial encounters challenges amid recent market fluctuations. The platform now navigates through a period of portfolio adjustments and reallocations after losses close to $5 million across various assets.

Portfolio Performance and Holdings

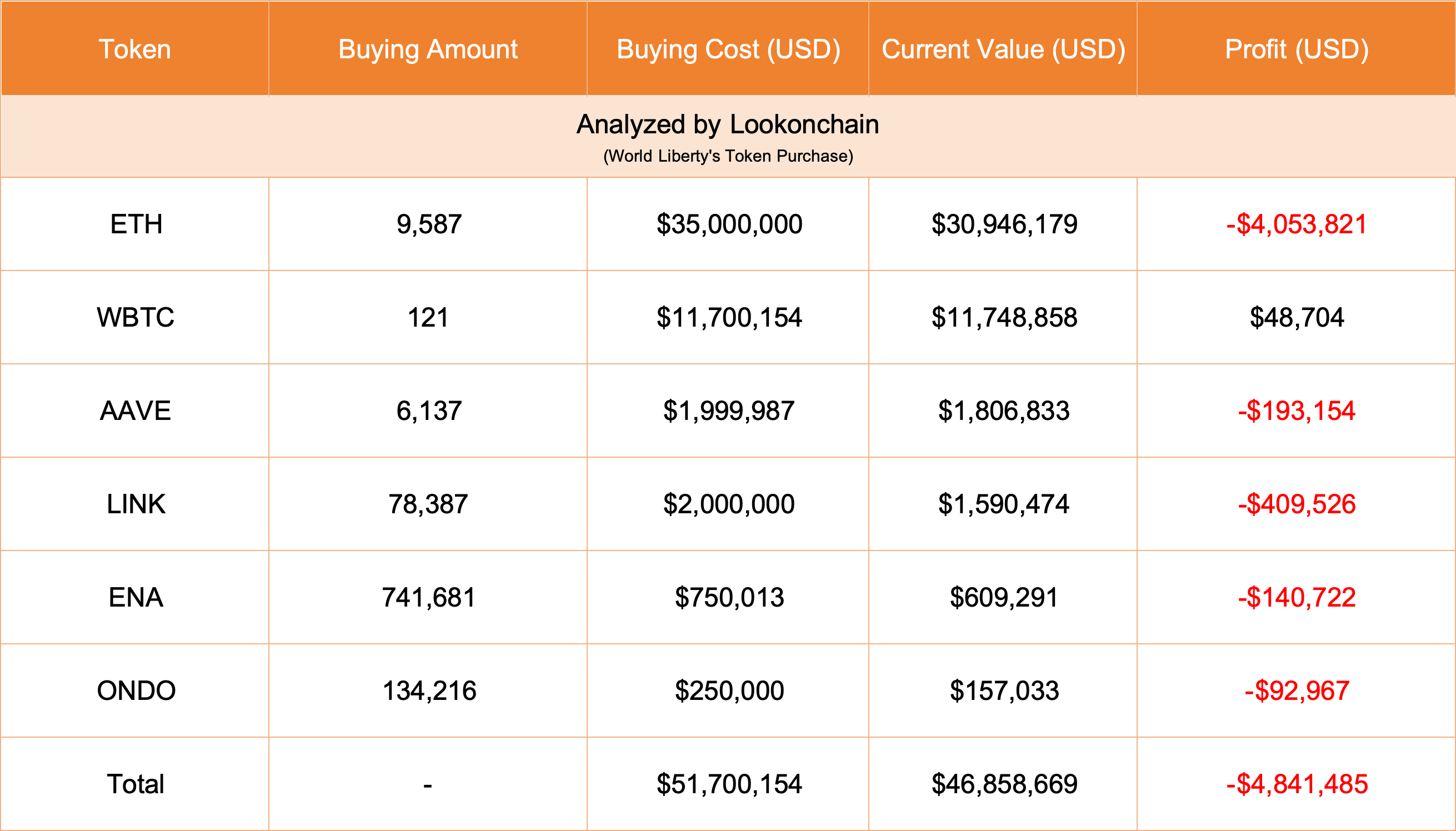

World Liberty Financial’s crypto holdings show unrealized losses of $4.84 million across various assets. Their portfolio, initially valued at $51.70 million, now stands at $46.85 million, according to recent Lookonchain data from X. Major holdings include Ethereum, Wrapped Bitcoin, AAVE, Chainlink, and ONDO tokens, all affected by the recent market correction.

The platform recently executed significant transactions, exchanging 103 WBTC worth $9.89 million for 3,075 ETH. They also converted $1.7 million USDT to purchase 17.62 WBTC at $96,491 per token. A substantial movement of 18,536 ETH, valued at $59.8 million, was transferred to Coinbase Prime.

World Liberty Financial’s Treasury Management Strategy

Despite the losses, World Liberty Financial maintains an active investment strategy. The platform’s official communications emphasize these movements as routine treasury management operations rather than liquidation efforts. Their statement confirms the transfers serve ordinary business purposes, including fee payments and working capital requirements.

“To be clear, we are not selling tokens — we are simply reallocating assets for ordinary business purposes,” the platform stated through its official X account. These actions are part of maintaining a strong, secure, and efficient treasury.

Investment Activity & Future Outlook

The project continues to attract investor interest. A recent whale transaction saw the purchase of 200 million WLFI tokens worth $3 million, demonstrating ongoing market confidence. The token sale has reached 5.35 billion WLFI tokens, raising $80.25 million at a fixed price of $0.015 per token.

Looking ahead, World Liberty Financial has set up new partnerships to enhance its ecosystem. The collaboration with Ethena Labs could integrate staked synthetic dollars into their platform to increase stablecoin liquidity and utilization rates.

Despite current market conditions, the platform’s treasury management approach reflects a long-term perspective. Their investment portfolio spans various crypto assets, showing a diversified strategy in the digital asset space. The project maintains significant room for growth, with 14.65 billion tokens still available for purchase.

Moreover, the recent market activity coincides with broader developments in the crypto space. As the January 20th inauguration approaches, market participants watch closely for potential policy shifts that could impact the digital asset landscape. World Liberty Financial’s movements suggest preparation for an active role in the evolving DeFi ecosystem.

For investors and market observers, these developments highlight the volatile nature of crypto investments. While unrealized losses affect current valuations, the platform’s strategic reallocations and continued institutional interest indicate ongoing market dynamics rather than fundamental concerns.

READ MORE: Grass Charts New Course for 2025 Network Evolution