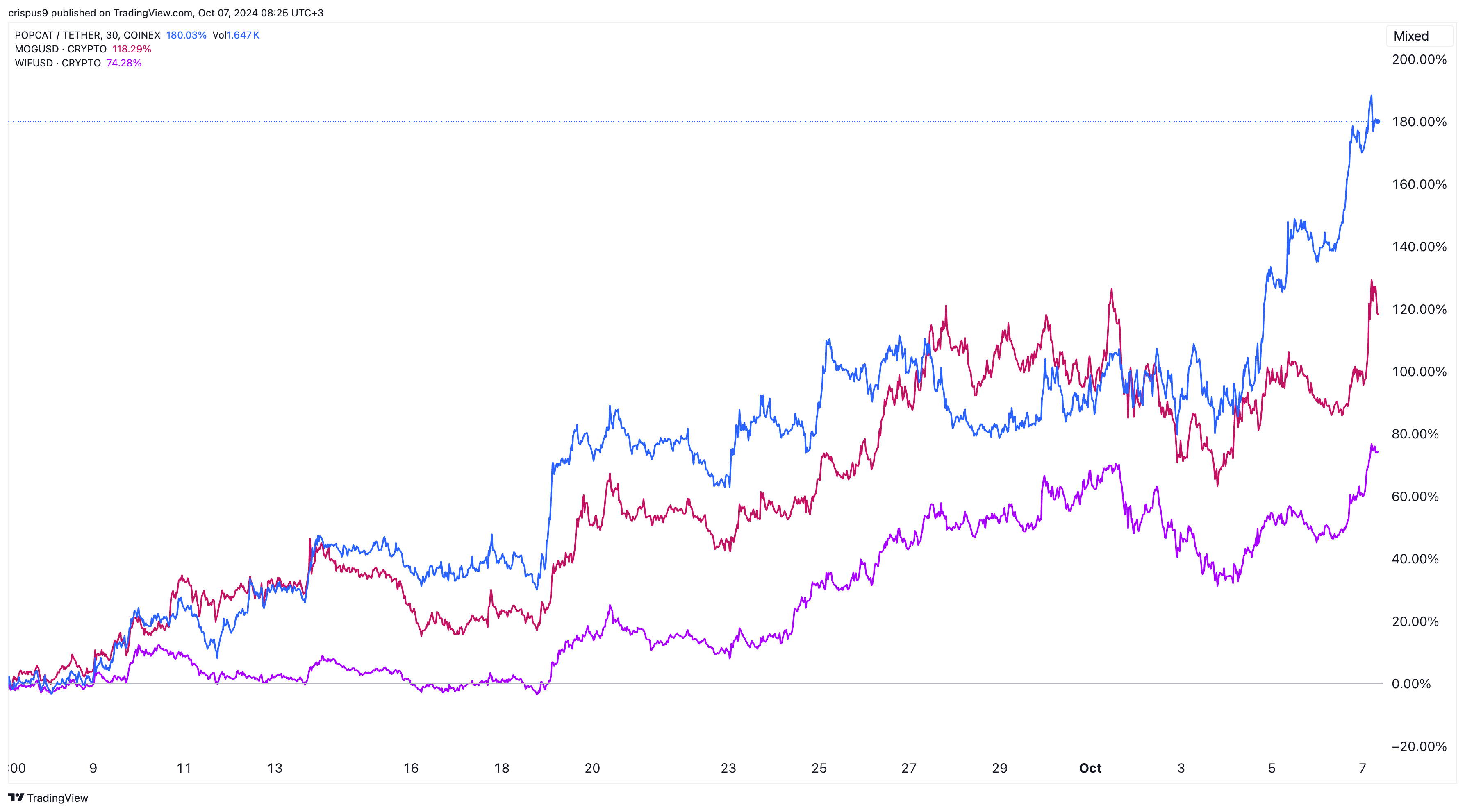

Meme coins like Mog Coin (MOG), Dogwifhat (WIF), and Popcat were the best-performing cryptocurrencies on Monday as investors embraced a risk-on sentiment.

Meme coins like MOG, WIF, and Popcat surge

MOG jumped by 21% to $0.0000017, its highest point since August 1 and 155% above its lowest point in September.

Similarly, the WIF token jumped to $2.70, its highest swing since July 24th while Popcat surged to a record high of $1.47, pushing its market cap to over $1.38 billion. This surge makes Popcat, a Solana meme coin, one of the best-performing meme coins in the industry.

The rally coincided with the ongoing Bitcoin rebound as it rose for two consecutive days, reaching a high of $63,6000.

Other risky assets have also started the week well, with Asian stocks surging. In Hong Kong, the Hang Seng index soared by over 1.35% while in India, the Nifty 50 index rose by 20 basis points. Other Asian stock indices like the South Korea’s KOSPI and the Shanghai Composite rebounded too.

This rebound happened as China released a blitz of stimulus measures to boost an economy that is struggling to hit its 2% target.

These coins also rebounded after the crypto fear and greed index moved from the fear zone of 38 to the neutral point of 43. In most cases, Bitcoin and meme coins like MOG, WIF, and Popcat do well when the index moves out of the fear zone.

Crypto liquidations jump

Meanwhile, data by CoinGlass shows that the ongoing surge has led to a significant increase in liquidations. Popcat’s shorts liquidations jumped to $1.6 million on Sunday and $524k on Monday. Similarly, WIF shorts worth over $2.36 million were liquidated.

Liquidations happen when exchanges or brokers are forced to close leveraged trades when they move to a certain level.

Looking ahead, these coins will have several catalysts this week. First, there is a likelihood that Israel will respond to the recent Iran missile attack, which will lead to heightened geopolitical events. In most cases, risky assets tend to underperform when there are geopolitical concerns.

Second, these tokens will react to Wednesday’s Federal Reserve minutes, which will provide more color about the last monetary policy meeting.

Finally, the US will publish the latest consumer inflation numbers on Thursday. These are important numbers because of their impact on the Federal Reserve. Analysts expect the Fed to deliver more cuts gradually, especially after last week’s strong nonfarm payrolls (NFP) data.

Read more: Pepe Price Prediction: It Could Enter Beast Mode Soon