The Bakkt (BKKT) stock price has crashed hard recently. After soaring to an all-time high of $50, the stock has crashed by more than 60% to the current $21. The stock is still about 172% above its all-time low.

Why is BKKT stock falling?

Bakkt is a leading cryptocurrency company that started as a custodian firm. In the past few years, the company has transitioned itself and added more services. Its current services include custody, derivatives, rewards, and a wallet. It achieves all these through key partnerships with companies like Google, Mastercard, Finastra, and Wyndham among others.

Bakk has raised millions of dollars from investors. According to Crunchbase, the company has raised more than $807 million. This includes the funds that it raised when it went public in October.

Bakkt has a market capitalization of more than $557 million, according to data by Webull. However, this market capitalization is not accurate. This is because the company has more outstanding shares and warrants today. Some of these warrants belong to ICE, the company that owns the NYSE and Creditex. Including all these, Bakkt has a market cap of more than $8 billion.

The Bakkt stock price has dropped sharply because of its relatively weak quarterly results. The company said that its revenue in the third quarter rose to $9.1 million. This was a 38% increase from the same quarter in 2020. As a result, the company’s net loss widened from $18 million to more than $28.8 million.

Therefore, these weak earnings have led many investors to wonder whether the company is actually overvalued.

Another reason why the BKKT stock has crashed is that the recent news about Mastercard and Fiserve have started to fade. As you recall, these partnerships were responsible for the parabolic move that happened in October.

At the same time, the sluggish Bitcoin price has also contributed to the performance. Indeed, most companies with exposure to Bitcoin like MicroStrategy and Riot Blockchain have all retreated.

Bakkt stock price forecast

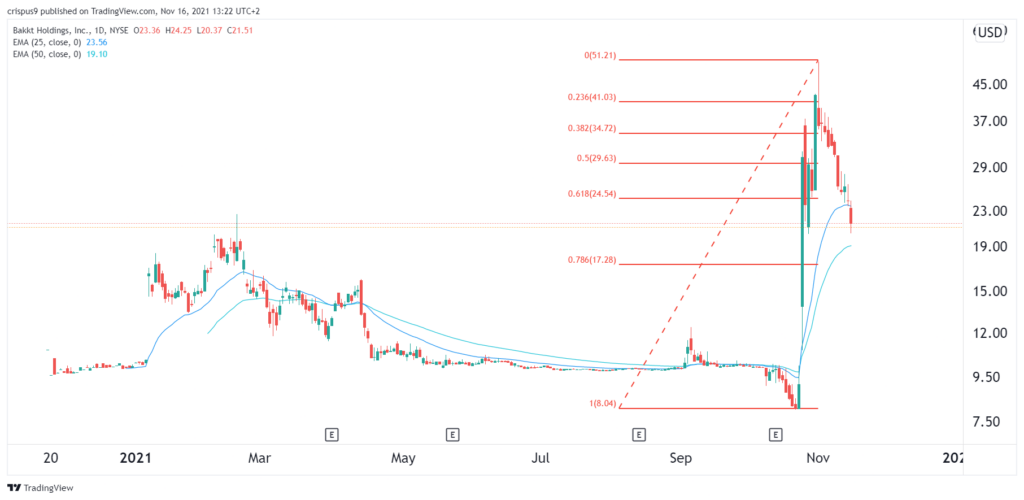

The daily chart shows that the Bakkt stock has been under intense pressure in the past few weeks. This drop has seen the stock drop below the 61.8% Fibonacci retracement level. It has also crashed below the 25-day moving average. It is slightly above the 50-day MA.

Therefore, at this point, the stock will likely keep falling as bears target the key support at $17.43, which is along the 78.6% retracement level. In the long term, however, the stock will likely bounce back.