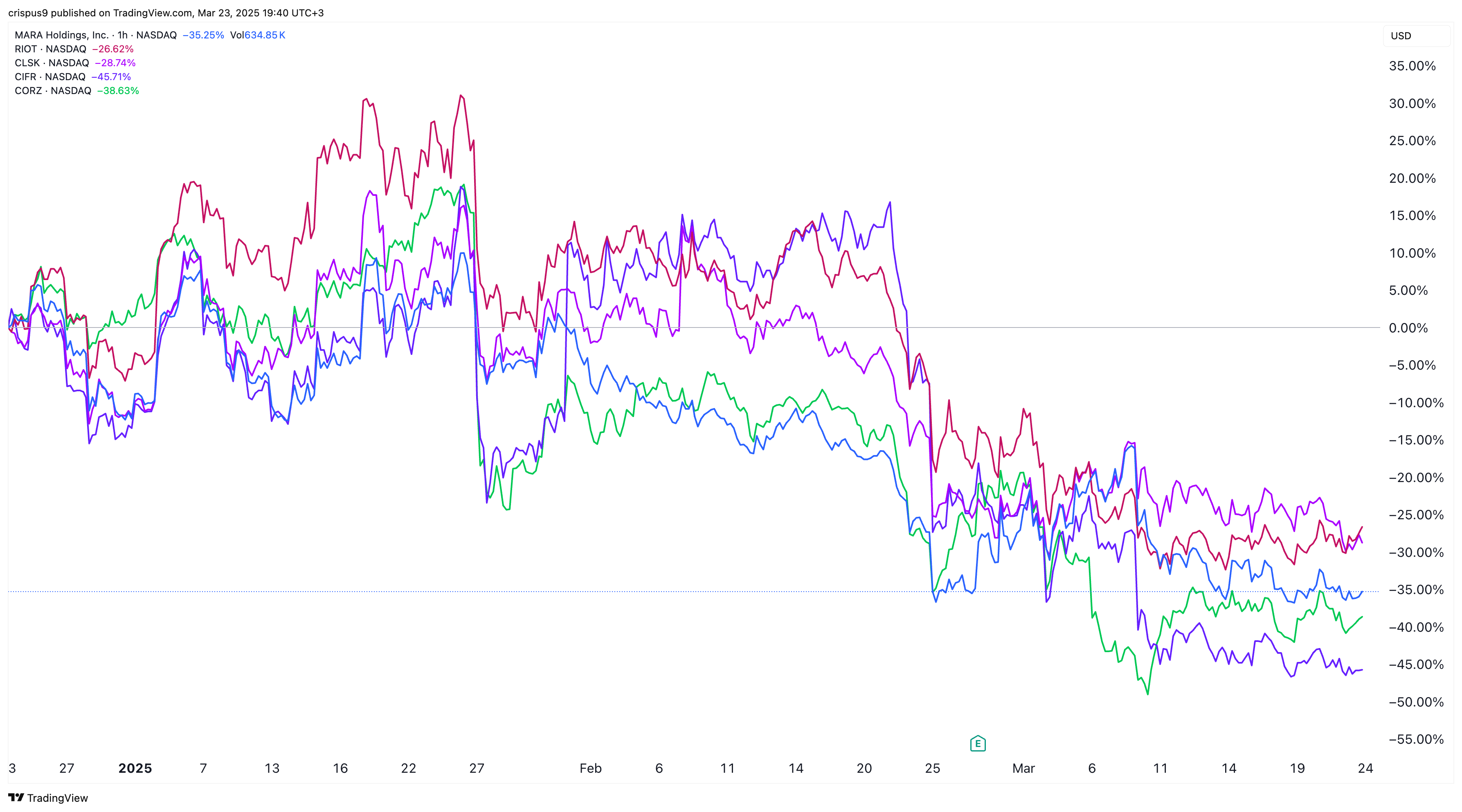

Bitcoin mining stocks have dropped in the past few months as sentiment in the crypto market weakened and BTC crashed.

Mara Holdings, formerly known as Marathon Digital, the biggest Bitcoin mining stock, has fallen by 60% from its highest point in November. Its market cap has declined from $8.82 billion to $4.2 billion, leading to a $4.6 billion wipeout.

Riot Platforms stock has retreated from $16 to $8, and its market cap has fallen from nearly $5 billion to $2.78 billion.

Core Scientific, a Bitcoin mining company that has diversified into AI data centers, has also dropped from $18.6 to $8.5, with its market valuation falling from $5.1 billion to $2.5 billion.

Other mining companies, such as CleanSpark, Bitdeer Technologies, Hut & Mining, Cipher Mining, and Bitfarms, have declined. Altogether, the 24 Bitcoin mining companies tracked by Companies by Market Cap are valued at $23 billion.

READ MORE: Crypto Market Steady After Stock Options Triple Witching

Why Bitcoin Mining Stocks Have Crashed

These companies have fallen for two main reasons: declining Bitcoin prices and rising mining difficulty following last year’s halving event.

The Bitcoin price has crashed from the year-to-date high of $109,480 in January to $85,150. Now that a rising wedge pattern has formed, a popular bearish sign in the market, there is a risk that it could fall further.

Bitcoin mining stocks are highly correlated with BTC prices because they mine and sell their coins to exchanges and other large companies.

At the same time, the difficulty of Bitcoin mining and the hash rate, which measures computational power, have both reached record highs. A hash rate is a figure that looks at the total computational power in a network. Miners use it to validate transactions and secure the network.

Bitcoin’s mining difficulty rises almost daily, mostly occurring four years after each halving event.

Most of these companies saw a sharp decline in Bitcoin mined after the halving event. MARA’s mined coins dropped from 692 in March 2024 to 590 in June last year. Its mining output then rose to 850 in February this year.

Will BTC Mining Stocks Rebound?

The future of Bitcoin mining stocks is linked closely to Bitcoin’s performance in upcoming months, which, despite recent crashes, may see recovery later this year.

The risk, however, is that it may crash in the next few weeks. It has formed a rising wedge pattern, a popular bearish sign in the market. Bitcoin has also formed a death cross pattern as the 50-day and 200-day weighted moving averages (WMA) have crossed each other.

Therefore, Bitcoin prices will likely fall to the next key support at $73,730, its highest point on March 14. If this happens, there is a likelihood that these Bitcoin mining stocks will drop also in the near term. They are then expected to bounce back later this year as BTC recovers.

READ MORE: Litecoin Price is at Risk as On-Chain Metrics Send Mixed Signals