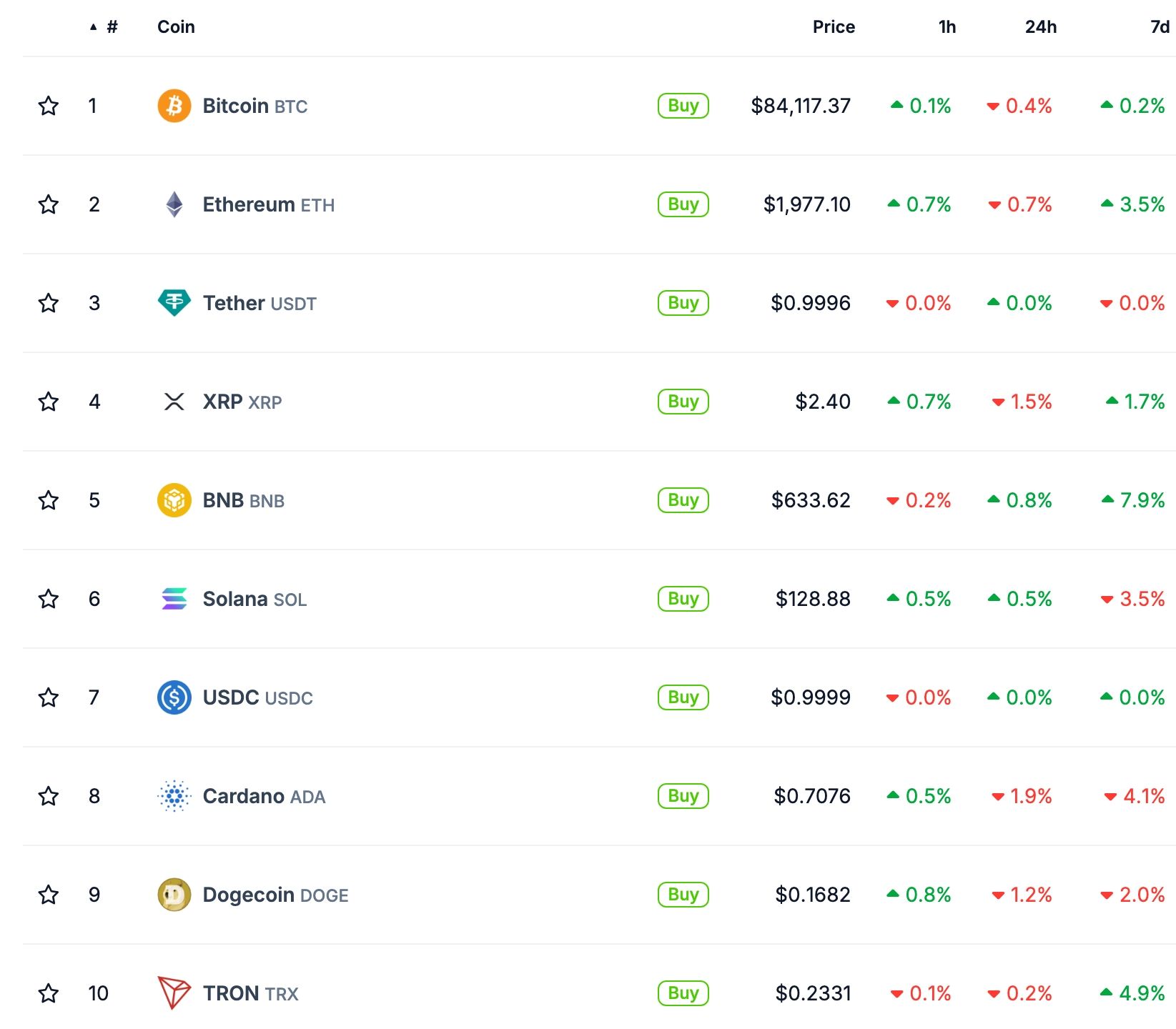

The crypto market was stable on Saturday morning, a day after the US stock market experienced a $4.7 trillion triple-witching event. Bitcoin price held steady above $84,000, while Ethereum attempted to move back to $2,000. XRP, Cardano, and BNB prices were barely moved.

Crypto Market Unmoved by Triple Witching

The crypto market experienced several significant events this week. The most important was the Federal Reserve’s interest rate decision on Wednesday. The bank left interest rates unchanged for the second consecutive meeting, and the dot plot pointed to two cuts this year.

Triple-witching was the other notable news in the crypto and stock markets. This is a major quarterly event in which stock and stock index options expire. This week, options worth over $4.7 trillion expired on Friday.

Historically, the triple-witching event is characterized by high stock and crypto market volatility. This week’s one was an exception, as these assets were not highly volatile. Indeed, the US stock market showed little movement, with the Dow Jones and Nasdaq 100 indices rising by 32 and 90 points, respectively.

The crypto market also reacted mildly to Donald Trump’s pre-recorded statement at a crypto conference in New York. This performance was mostly because his speech was largely flat and did not differ from what he had talked about before.

Also, the speech offered no policy changes that cryptocurrency traders were expecting. For example, the industry has been lobbying to exclude cryptocurrency transactions from taxes in the US. Since stock investors already pay taxes, such a policy framework is unlikely to pass in Congress.

READ MORE: Chainlink Price Prediction: LINK Is a Coiled Spring Ready To Pounce

SEC Ends Ripple Case

The crypto market also reacted mildly to the Securities and Exchange Commission’s (SEC) decision to end its case against Ripple. XRP’s price initially rose after the lawsuit ended and then resumed its downward trend.

This performance happened because most market participants expected the case to end. Besides, this year, the agency has already ended the case against other crypto companies like Coinbase, Uniswap, and Kraken.

Looking ahead, there will be no major macro and crypto news next week. Therefore, traders will focus on the following week, when the trade war between the US and other countries intensifies. Trump is scheduled to execute his reciprocal tariffs on April 2, which may impact the crypto market.

READ MORE: Solana Price Forms Bearish Flag as Revenue, Transactions Crash