Solana futures have hit CME, the biggest futures trading hub in the world, and institutions are noticing. After an influx of new capital, SOL has seen a noticeable spike in price. What is more, industry experts claim that this could be just the start.

On Tuesday, March 19, Solana traded at $126.50, registering a 3.74% increase from its daily low of $121.94. The rally came after Solana futures contracts started trading on the Chicago Mercantile Exchange (CME) on Monday, March 18.

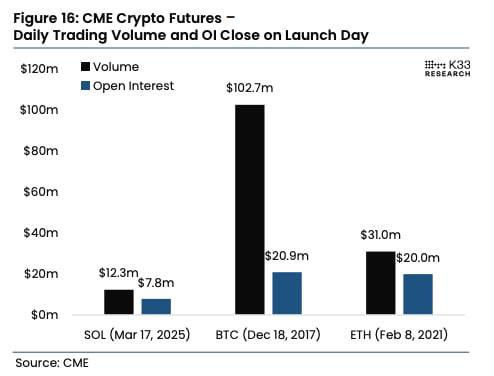

After the launch, Leah Wald, CEO of Sol Strategies, explained that Solana had a strong debut, which showcased institutional interest. Notably, the token reached a trading volume of $12 million. While it fell short of Bitcoin’s and Ethereum’s trading volumes, the launch was successful.

“I think Solana has proven itself,” Wald stated, citing its transaction speeds and interoperability. “Institutions are taking it very seriously,” she added.

However, institutional adoption is still nowhere near Bitcoin’s, which is much better understood. Wald explained that investors see Bitcoin as a store of value.

At the same time, many investors are still struggling to differentiate between various altcoins. “At the end of the day, we need to see each altcoin launch as different,” Wald concluded.

What CME Launch Means for Solana

CME offers a regulated way for institutions to trade a wide range of future contracts, including crypto. So far, only Bitcoin, Ethereum, and Solana have managed to get on the exchange. For this reason, the debut gives SOL the institutional legitimacy it needs to grow.

On its first day of trading, SOL futures reached $12 million in trading volume and $7.8 million in open interest. This was lower than Ethereum’s performance, which reached $31 million in volume and $20 million in open interest. For Bitcoin, these figures were $102.7 million and $20.9 million respectively.

Still, Ethereum and Bitcoin have significantly higher market caps than SOL, with Solana futures outperforming when compared in that way. This suggests that institutional interest could help boost Solana’s dominance compared to BTC and ETH in the future.

READ MORE: Crypto Crash: Why Are Pepe, ADA, XLM, Solana Going Down?