Popular layer 1 blockchain networks like Ethereum, Solana, BNB Smart Chain (BSC), and Tron face substantial competition from relatively new chains like Berachain, Sonic, and Sei.

Data compiled by DeFi Llama shows that Ethereum’s TVL in DeFi has crashed by over 20% in the last 30 days to $46.2 billion, while the bridged TVL has dropped to $152 billion. Most Ethereum dApps, such as Compound, AAVE, and Maker, have lost assets during this period.

Solana’s TVL has plunged by 22.6% to $7.32 billion, while BSC’s has dropped by 14.0% in the same period.

On the other hand, Berachain protocols have continued to add assets. Its TVL has jumped by 58% in the last 30 days, bringing its total to over $2.9 billion. This value makes it the sixth-largest blockchain network. It has passed popular chains like Base, Arbitrum, Avalanche, and Aptos.

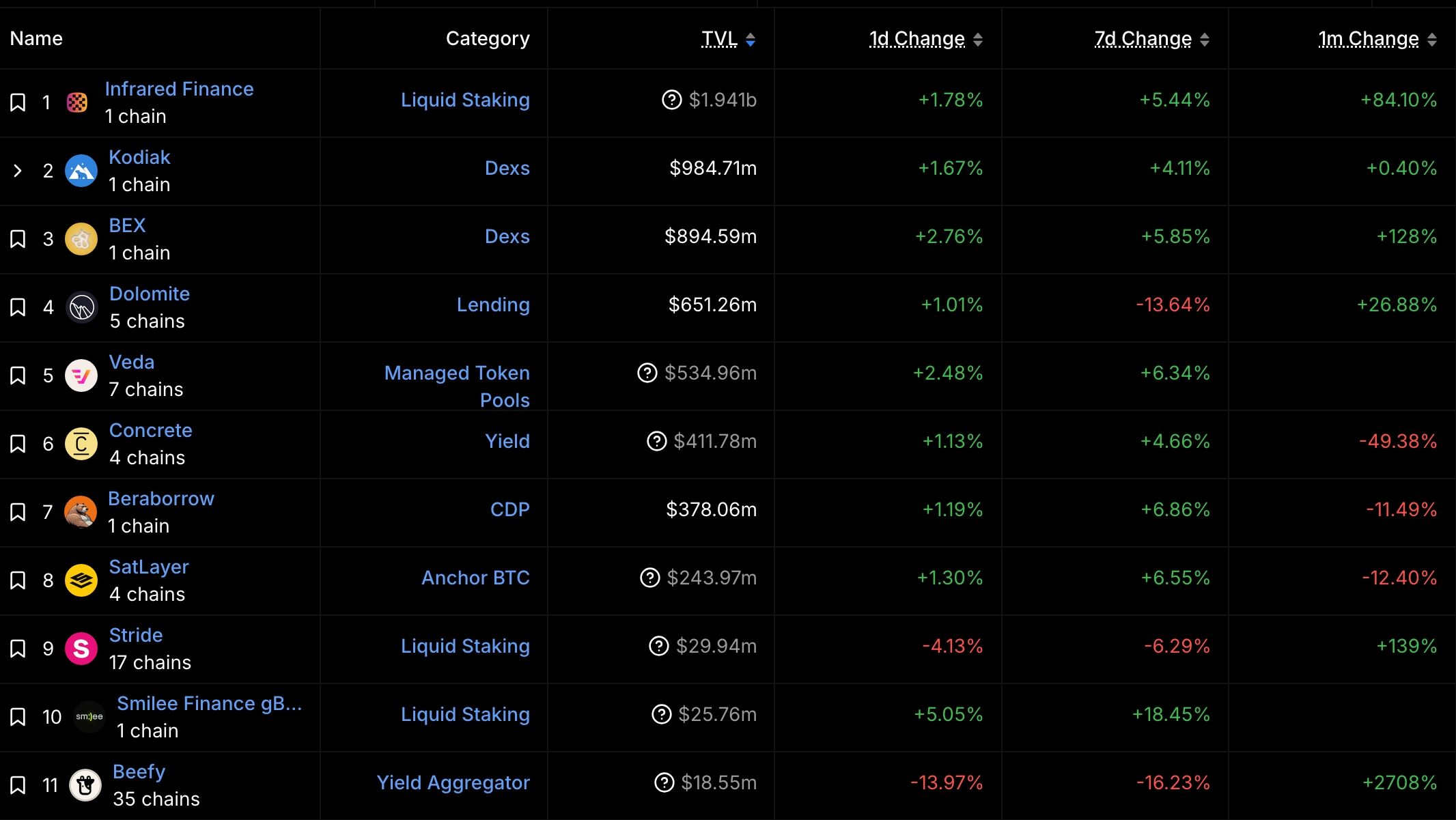

Berachain DeFi TVL | Source: DeFi Llama

Most dApps in the Berachain ecosystem have added assets. Infrared Finance’s staked assets jumped by 84% in the last 30 days to $1.94 billion. Other popular players like Kodiak, BEX, and Dolomite have jumped by double digits.

Likewise, Sonic has seen more traction in its DeFi ecosystem as the TVL has jumped by 98% in the last 30 days. The top players in the ecosystem are Silo Finance, Beets, AAVE V3, and Avalon Labs. This growth is notable since the figure is much higher than what Fantom had before the rebrand earlier this year.

Sei is also seeing strong traction among investors as the TVL jumps by over 87% in the last 30 days. Sei has become the 19th largest chain, with Avalon Labs and Takara Lend contributing to this growth.

Berachain, Sonic, and Sei networks have added assets despite their tokens remaining in a bear market. Berachain has declined by 30% from its highest level this year, while Sonic price has dropped by 50%, erasing most of the gains made after the rebrand from Fantom. Sei is down by over 72% from its November high and is hovering near its all-time low.

READ MORE: Pepe Price Soars 7% Amid Whale Interest—What’s Next?