The Quant price has crashed in the past few months and has slowly formed a falling wedge pattern, suggesting potential gains in the near term. The QNT token has dropped to a low of $90, down by almost 50% from its highest point in November. So, what next for the Quant price as exchange reserves fall?

Quant Price Analysis as a Wedge Forms

The daily chart shows that the Quant price has moved into a deep bear market after falling by over 47% from its highest level in November last year. It has remained significantly lower than the 50-day moving average, which signals that bears remain in control.

The Quant price has also plunged below the 61.8% Fibonacci Retracement level, which is often seen as the point where reversals happen.

On the positive side, the Quant price has formed a falling wedge pattern, characterized by two declining, converging trendlines. These lines are nearing their convergence point, indicating that a bullish breakout may occur soon.

The bullish outlook is further supported by oscillators that have formed a positive divergence pattern. This pattern forms when the oscillator is moving upwards as the price remains under pressure.

Therefore, the coin will likely bounce back in the coming days. Such a move would point to further gains, potentially to the 23.6% retracement level at $143, up by 60% above the current level. A drop below the support at $75.8 would invalidate the bullish outlook.

QNT Price Has Three Potential Catalysts

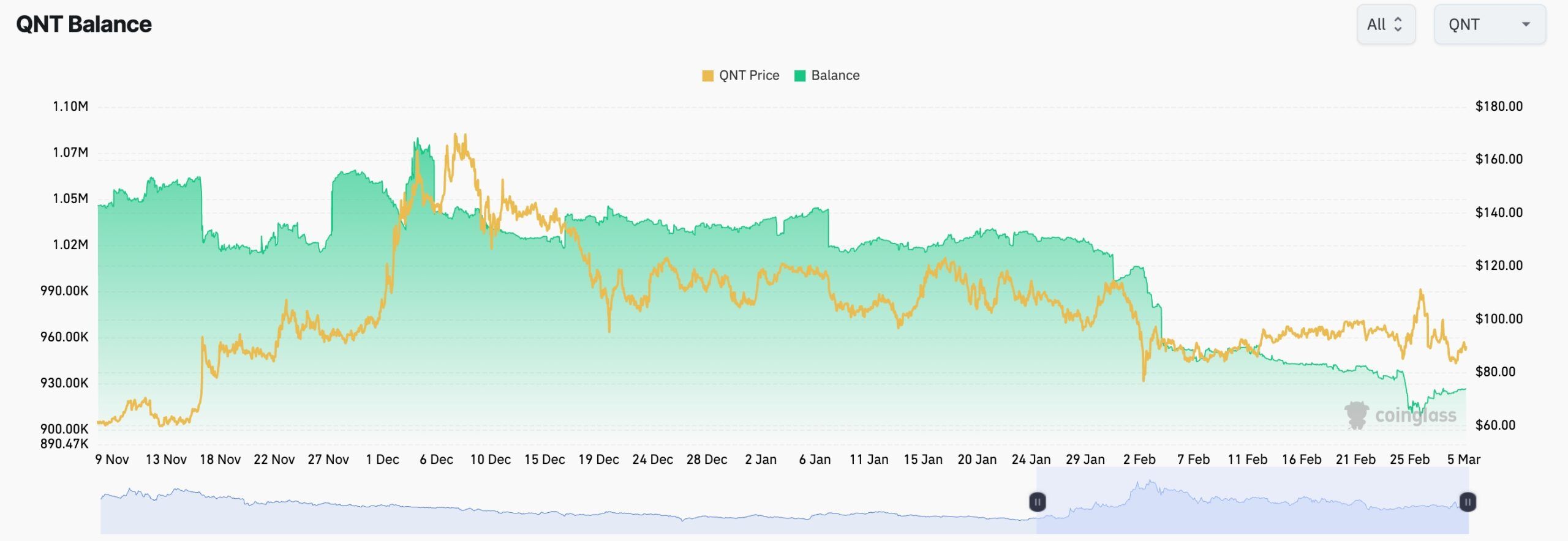

Quant’s price has three fundamental catalysts that may push it higher. First, there are indications that its holders are not selling despite the recent crash. This is seen in the number of QNT tokens that remain in centralized exchanges. These balances have fallen from over 1 million in December to 926k today, a sign that crypto investors are no longer selling.

The other catalyst for the Quant token is its participation in the growing Real World Asset (RWA) tokenization industry. RWA is a technology that enables users to convert the rights of a physical or financial asset into a digital token.

Quant is involved in this technology through its Overledger solution. Overledger is an interoperability solution that aims to connect multiple blockchains and traditional systems. It hopes to create a blockchain operating system that will be so useful when the RWA industry takes off.

Further, the Quant token may benefit from its relationship with Oracle, one of the biggest companies globally. Oracle recently launched the Oracle Blockchain Platform Digital Assets Edition (OBP DA), which aims to help companies streamline the development and deployment of digital asset applications and build unified ledgers.

READ MORE: Top 3 Catalysts that May Push Pi Network Coin Price to $50