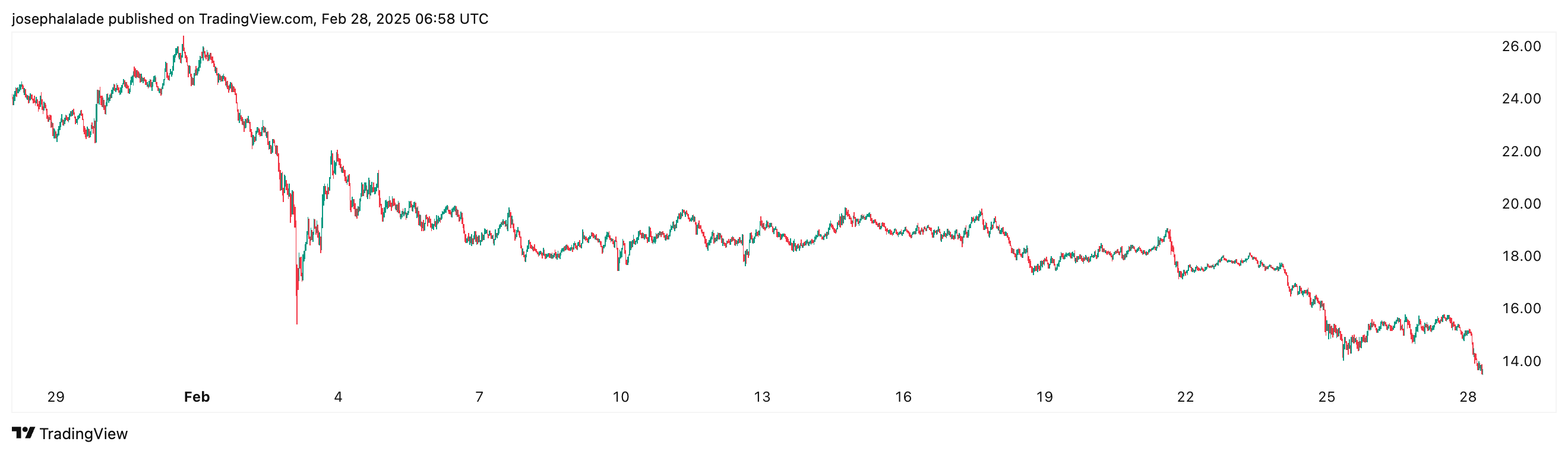

Chainlink (LINK) is one of the most affected cryptocurrencies amid the intense crypto bearish trend. The Chainlink price has crashed by 40.65% in the last 30 days, falling from over $25 to its current $13.77 price.

The bearish trend is not showing signs of slowing down yet. In the last 24 hours, Chainlink has lost 10.02%, adding to the 24.70% price drop recorded in the previous seven days.

However, Chainlink is not the only altcoin crashing after Bitcoin (BTC) dropped below $80,000. BTC lost 26.99% from its all-time high of over $109k, recorded just one month ago, and is currently trading at $79,607.

When Bitcoin’s price drops, other cryptocurrencies usually follow and often lose even more value than Bitcoin.

Altcoins like Solana (SOL), XRP, Dogecoin (DOGE), Cardano (ADA), Stellar (XLM), Sui (SUI), and Hyperliquid (HYPE) have experienced far greater losses in the past few days.

However, for Chainlink (LINK), the tides might soon be turning. A crypto analyst predicts the next price target for the token is $35, a potential 153.0% increase from the current level.

Chainlink Price Rebounds from Key Support, Eyes $35 Target

According to Rose Premium Signals, Chainlink (LINK) has touched strong support at the 0.786 Fibonacci retracement level, a zone where buyers have always stepped in.

Chainlink’s price reversal from this demand zone suggests a potential trend reversal. If the momentum persists in this direction, it could spell the end of the ongoing downtrend and the beginning of a new uptrend.

The LINK/USDT chart shows that the Chainlink price is attempting to break above a descending trendline, a key technical level acting as resistance.

A successful breakout above this trendline by LINK could confirm a bullish trend, thereby increasing buying pressure. Crypto traders consider such breakouts a sign that the asset could be heading toward higher target prices, with the key resistance zone near $35.

READ MORE: Dogecoin Price Prediction: Top 3 Reasons to Sell DOGE

With increased buying volume and positive market sentiment, Chainlink could rally strongly towards its $35 target. However, LINK may retest lower support levels before recovering in the case of a failed breakout.

What Could Drive LINK’s Price Recovery?

Chainlink’s potential price increase of 153% or reaching $35 soon depends on external factors beyond technicals.

For instance, it will be tough for the altcoin to surge if Bitcoin still struggles to turn green. Bitcoin’s continued decline has pushed the Crypto Fear & Greed Index below 20, a level unseen since the LUNA collapse in 2022. This extreme fear in the market signals that investors are highly uncertain, with many selling off their holdings.

Multiple crypto analysts believe that positive momentum is approaching as Bitcoin and the broader crypto market are close to a reversal.

Historically, such low sentiment levels have often marked market bottoms, as panic selling creates buying opportunities for long-term investors.

Michaël van de Poppe is an optimistic analyst who believes Bitcoin and the broader crypto market are close to a reversal and expects a potential rebound within 1–2 weeks. Accumulation by buyers at these low levels could trigger a recovery rally similar to past downturns.

Therefore, if the Bitcoin price rebounds in the next few weeks, Chainlink’s $35 price target could materialize quickly.

READ MORE: Solana Price Drops to $130, But Is the Real Bottom In?