Since the latest bull rally, investment firms have been racing to expand their ETF offerings, especially for Solana. After several months of consideration, investment giant Franklin Templeton made its first major move to establish a Solana ETF in the United States.

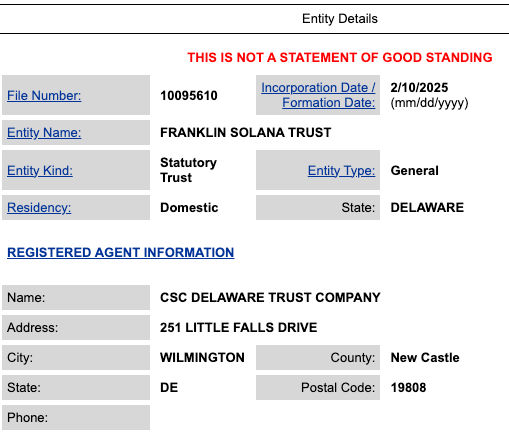

On Monday, 10 February, Franklin Templeton registered the FRANKLIN SOLANA TRUST entity in Delaware. The move is necessary before filing for approval for a Solana spot ETF. Notably, it also signals its entry into the market for Solana ETFs.

While the registration does not mean that Franklin Templeton will definitely enter the SOL ETF market, the firm previously suggested this intention. On February 6, Reuters reported that the investment firm is seeking approval for a Solana spot ETF from the Securities and Exchange Commission (SEC).

Solana ETF Race Heats Up

So far, multiple investment firms have taken steps toward launching their own Solana ETFs. Grayscale was the first one to file a 19b-4 form, requesting a rule change that would allow it to list the product. Following Grayscale, multiple other investment firms joined. Notably, Canary Solana Trust, Bitwise Solana ETF, 21Shares Core Solana ETF, and VanEck Solana Trust are all in the race.

These filings came after a significant regulatory shift toward crypto following the election of Donald Trump and a leadership change in the SEC. Under a new acting chairman, the SEC has changed its stance on crypto assets.

On February 6, the SEC acknowledged the SOL ETF filing, which is the first step toward ultimate approval. While approval is not guaranteed, analysts pointed out that the expected date for the decision is October 11.

Investors are watching ETF news with significant interest. Notably, these products enable major investors, like pension funds and hedge funds, to gain exposure to crypto assets in a regulated way. These products also make it easier for funds to invest.

If there is institutional interest in these altcoins, ETFs could bring more capital to the markets. This has the potential to increase liquidity significantly. This will likely reduce volatility and boost asset prices.

READ MORE: BNB Gains 5% as Binance Eyes Early SEC Settlement