Favorable regulatory changes for crypto are occurring worldwide. Japan could be the next country to implement major reforms to make crypto holding more productive.

This move could significantly affect the crypto market, bringing in more investors and capital.

On Monday, February 10, local media reported that Japan is gearing up for a major regulatory overhaul for crypto assets.

Japan’s chief securities regulator, the Financial Services Agency (FSA), is proposing key changes to crypto assets. Some changes will make holding crypto easier, while others will put more pressure on crypto firms.

New Rules for Crypto in Japan

The FSA is debating new regulations that would make crypto comparable to securities. Like publicly traded companies, these regulations would require crypto projects to disclose detailed financial information.

The agency is also considering lifting the ban on exchange-traded funds (ETFs). This change would enable Japanese institutional investors to gain exposure to crypto assets.

Another key change is that Japan could slash its taxes on crypto profits from 55% to 20%. This means traders who realize gains from investing in crypto will have to pay significantly less taxes, making crypto investing more beneficial for Japanese traders.

After the initial public discussion period, the FSA will present a formal proposal by June 2025. Local media reports suggest that legislative action will probably occur in 2026.

What New Regulation Means for the Markets

Japan’s new proposed regulations aim to expand access to crypto while ensuring investor protection. The ban on ETFs and lower taxes could help boost Japan’s growing crypto market.

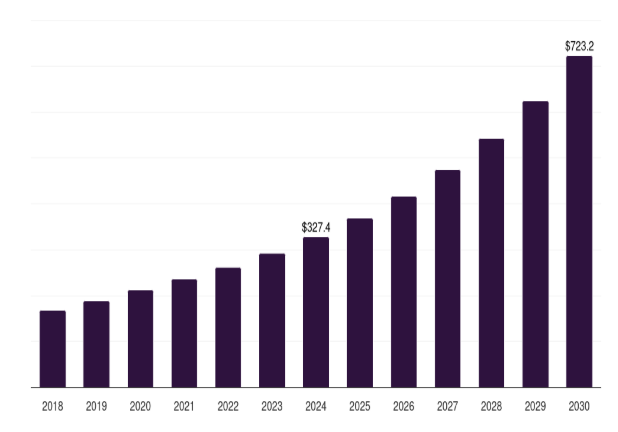

Revenues from Japan’s crypto markets amounted to $327.4 million in 2024. According to Horizon Grand View Research, they are expected to reach $723.2 million by the end of 2030.

Still, treating crypto assets as securities will impose a new compliance hurdle for projects. For instance, crypto projects that fail to publish detailed reports will probably be excluded from Japan’s market.

If projects decide to comply, this could bring new market transparency.

Over time, Japan has shown it is serious about crypto compliance. In early February, the FSA cracked down on non-compliant crypto exchanges. In an unprecedented move, the agency blocked access to apps from exchanges that failed to register with it.

READ MORE: $7,300 or $1,600 – Ethereum Price Analysis