Aptos price continued its strong recovery during the weekend, soaring to a high of $10.46, its highest level since April 12. It has jumped by more than 131% from its lowest level this year, bringing its market cap to over $5.2 billion.

Total Value Locked surges

Aptos, a leading layer-1 network, has done well, helped by the robust demand by developers and traders.

Data compiled by DeFi Llama, a third party platform, shows that the amount of money locked in its ecosystem, has surged by over 65% in the last 30 days to over $720 million. This growth makes it the 12th-biggest player in the industry, having overtaken other popular networks like Optimism, Blast, Core, Cardano, and Near Protocol.

Its biggest DeFi networks are the likes of Aries Markets, Amnis Finance, Thala, TruStake, and Cellana Finance. Aries is a lending protocol similar to AAVE that has over $256 million in assets, while Amnis and TruStake are top players in the liquid staking industry.

Aptos is also seeing robust demand in the stablecoin industry. It has over $240 million worth of stablecoins in the ecosystem, an important number since most people use these currencies to trade in the blockchain space.

More data shows that Aptos has become a large player in the DeFi industry. Its DEX networks handled over $345 million worth of cryptocurrencies in the last seven days, making it the eighth biggest network in the sector.

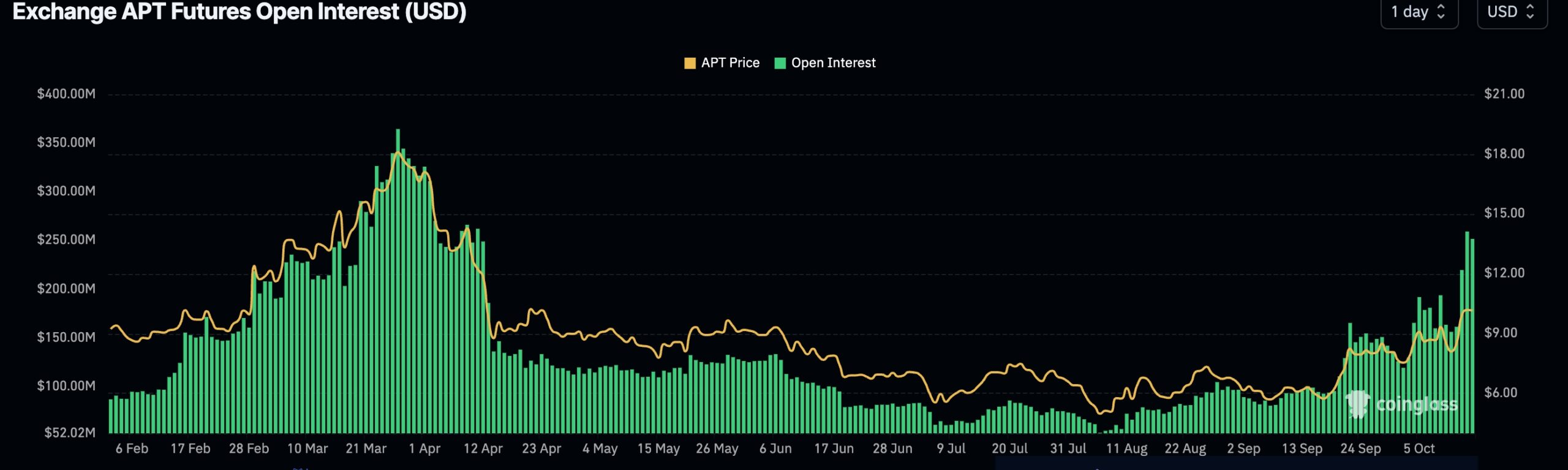

Additionally, with rising open interest, Aptos futures are seeing more demand. Its open interest jumped to over $251 million, its highest level since April, and substantially higher than the August low of $54 million. These numbers mean that more traders are placing put-and-call options trade in the market.

Aptos surge has also coincided with the strong performance of Sui, another cryptocurrency that was launched in Binance Launchpool. Sui has been one of the top-performing tokens in the past few months.

Still, the biggest risk to remember is that Sui is a highly dilutive cryptocurrency since it has a circulating supply of 515 million against a total supply of 1.12 billion.

Aptos price formed inverse H&S pattern

The daily chart shows that the APT price has been in a strong bullish trend in the past few days. It has moved above the 38.2% Fibonacci Retracement point. Also, it has formed an inverse head and shoulders pattern, a rar bullish sign.

Aptos has also moved above the 50-day and 100-day moving averages, which made a bullish crossover recently. In most periods, this cross often leads to more gains.

Therefore, Aptos price will likely continue soaring as bulls target the 50% retracement point at $11.58, which is about 15% above the current level. The ongoing crypto sentiment will boost this rebound as Bitcoin has crossed the important resistance at $64,000.