On Friday, crypto market sentiment slid back into the Fear Zone (37) after the Bureau of Labor Statistics released US CPI data for September, which was slightly higher than expected.

US inflation rose by 0.2% month-over-month, surprising both economists and market analysts who were optimistic about the inflation cooling in September.

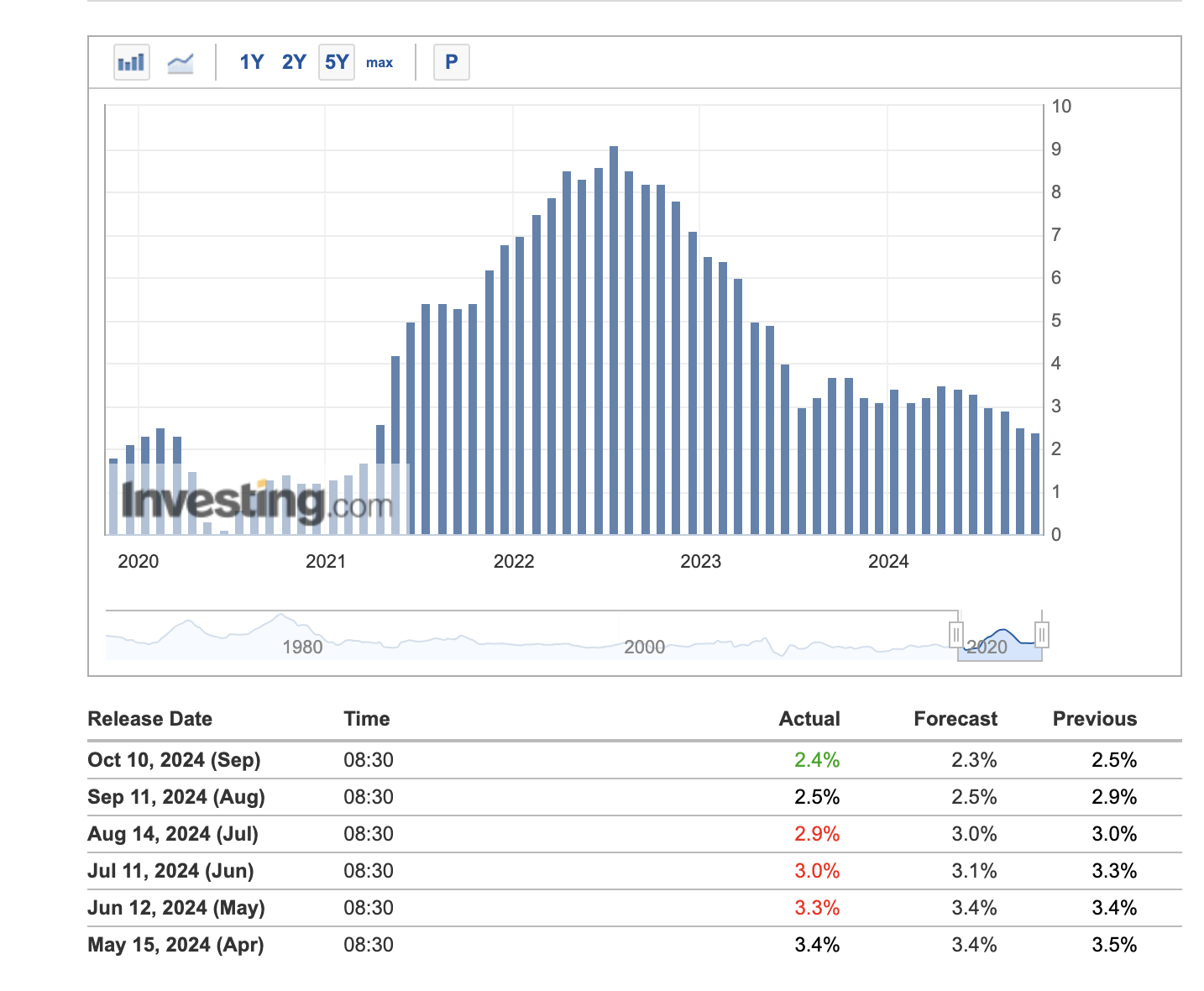

The broader expectation was that the annual Consumer Price Index (CPI) would drop to 2.3%; however, it increased by 0.1%, reaching 2.4%.

A chart showing inflation data in the US – Source

How Could The Inflation Data Impact The Chances Of A Fed Rate Cut?

Lower inflation data would have further increased the likelihood of a Fed rate cut in November. The Fed already slashed the interest rate by 50 basis points last month. However, after the recent FOMC meeting, reports indicated that members were divided on a potential rate cut in November.

With inflation now higher than expected, the chances of a 50 basis point rate cut after the FOMC meeting, scheduled for November 6–7, seem low. According to CME Group’s FedWatch, there is currently an 88% chance of a 25 basis point rate cut, though this may change due to the higher-than-expected inflation data for September.

Opinions about the latest inflation figures are mixed. Some argue that “2.4% inflation is close to the Fed’s 2% target,” while others express dissatisfaction.

In response to a post by Washington Post’s economic columnist Heather Long on X, some users offered harsh and conflicting counterclaims. One noted that 2.4% inflation is 20% higher than the already-high 2%.

Will Bitcoin Drop To $57k?

The inflation data released on Thursday was not as expected; however, it may not be significant enough to prompt the Fed to alter its plans—at least, it shouldn’t.

For risk-on assets like crypto, a drop in the Fed rate often leads to price increases, as it encourages investors to diversify their investments.

However, with inflation data coming in hotter than expected, the crypto market has seen a nearly 2% drop in total market capitalization in the last 24 hours. Bitcoin, which is struggling to hold above the $60k mark, has shed 2.8% in intraday trading.

The next strong support level for Bitcoin is around $57k. If Bitcoin breaches the psychological $60k threshold, it could trigger a sharp downward movement, pushing the leading cryptocurrency toward $58.5k.

In the meanwhile the inflation data has also impacted odds of US election results on Polymarket. Now, Donald has extended his lead by over 10 points. As Trump has positioned himself as a pro-crypto candidate, it is likely that an increase in his winning chances could impact crypto prices.