Reef price has gone parabolic in the past few months, outperforming most big players in the crypto industry.

It rose to a high of $0.0080 on Friday, its highest point since September April 2022, and 1,000% above its lowest level this year.

Additionally, the token has jumped in the last six consecutive weeks, its longest streak ever. This rebound has pushed its market cap to over $128 million.

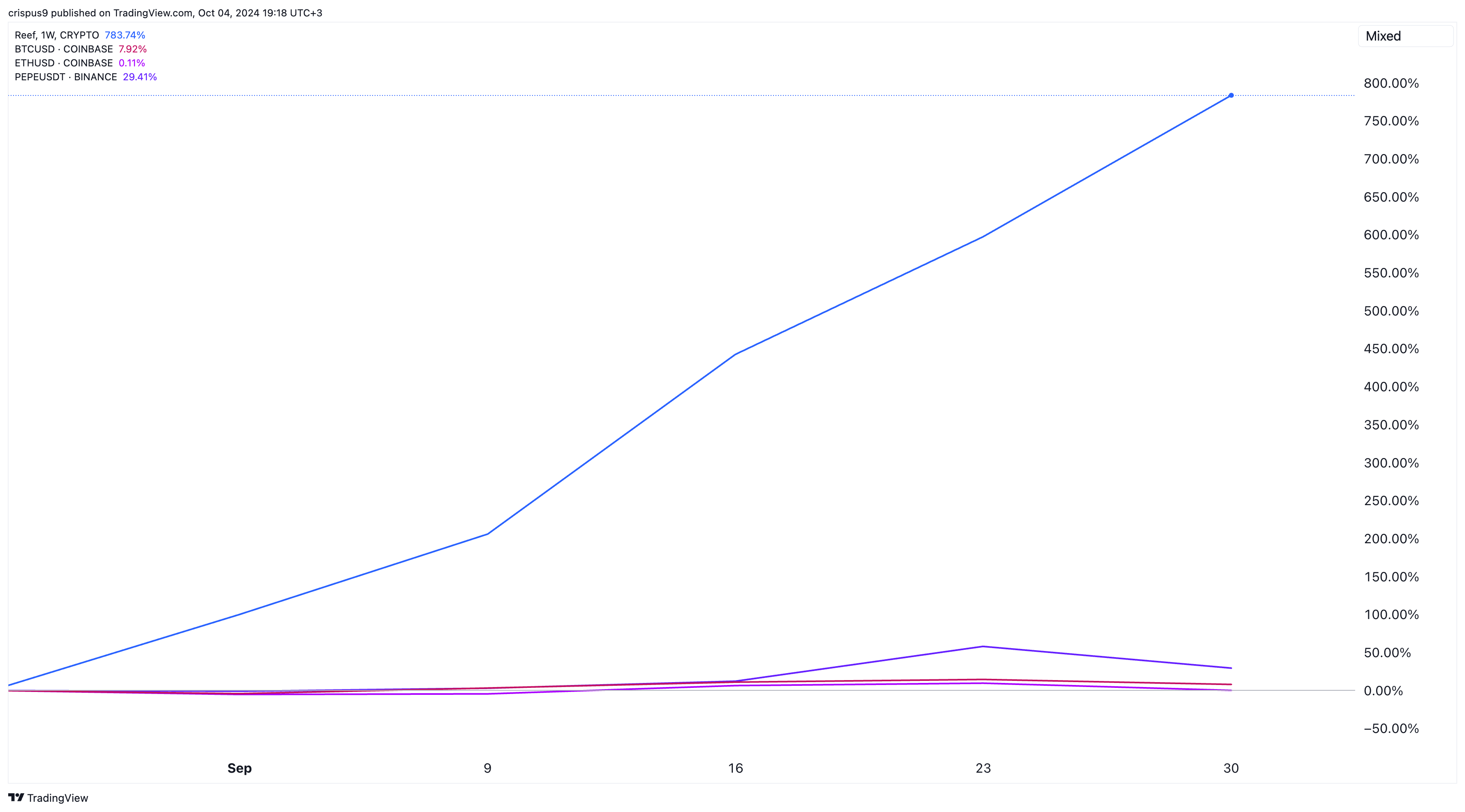

The rally is notable since the token was delisted by Binance, the biggest crypto exchange on August 26. Since then, the token has jumped by 780%, outperforming most cryptocurrencies. Bitcoin has jumped by 7.9% while Pepe and Ethereum have risen by 29% and 0.22% in the same period.

Reef token was delisted on the same day that Binance removed tokens like Loom Network, Ellipsis, ForTube, and PowerPool. Most of these tokens – except Loom Network – have tumbled since then.

Binance attributed the delisting to several factors, including the lack of team commitment to the project, low trading volume, new regulatory requirements, and lack of public communication.

Since then, most of Reef trading has happened in other exchanges like Gate.io, HTX, Bitget, and KuCoin.

This rebound is likely because Reef has intensified its partnerships. Last month, the developers partnered with Pigmo, a fast-growing crypto betting platform. This partnership means that the REEF token would be integrated on Pigmo and the two companies will share all profits generated from Reef’s activities.

Reef also partnered with VIA Labs, a big cross-bridging chain. The partnership introduced new features like cross-chain messaging, bridging, and proto-CCTP with the USD Coin token.

Most importantly, the developers announced a new Reef Community Fund to improve activities in the network. All these activities have led to more activity in the Reef network, which has led to a big increase in token holders to 22,970.

REEF had gotten overbought

The daily chart shows that the REEF token has soared, and crossed the important resistance point at $0.0053, its highest level on March 12. This is a sign that bulls are in control.

However, there are signs that it has gotten highly overbought, with the Relative Strength Index (RSI) rising to 80. The MACD has also risen to its highest point in years. That could be a sign of a potential reversa in the near term.