- Major cryptocurrencies like Bitcoin and Ethereum pulled back.

- Focus is on the upcoming American inflation data.

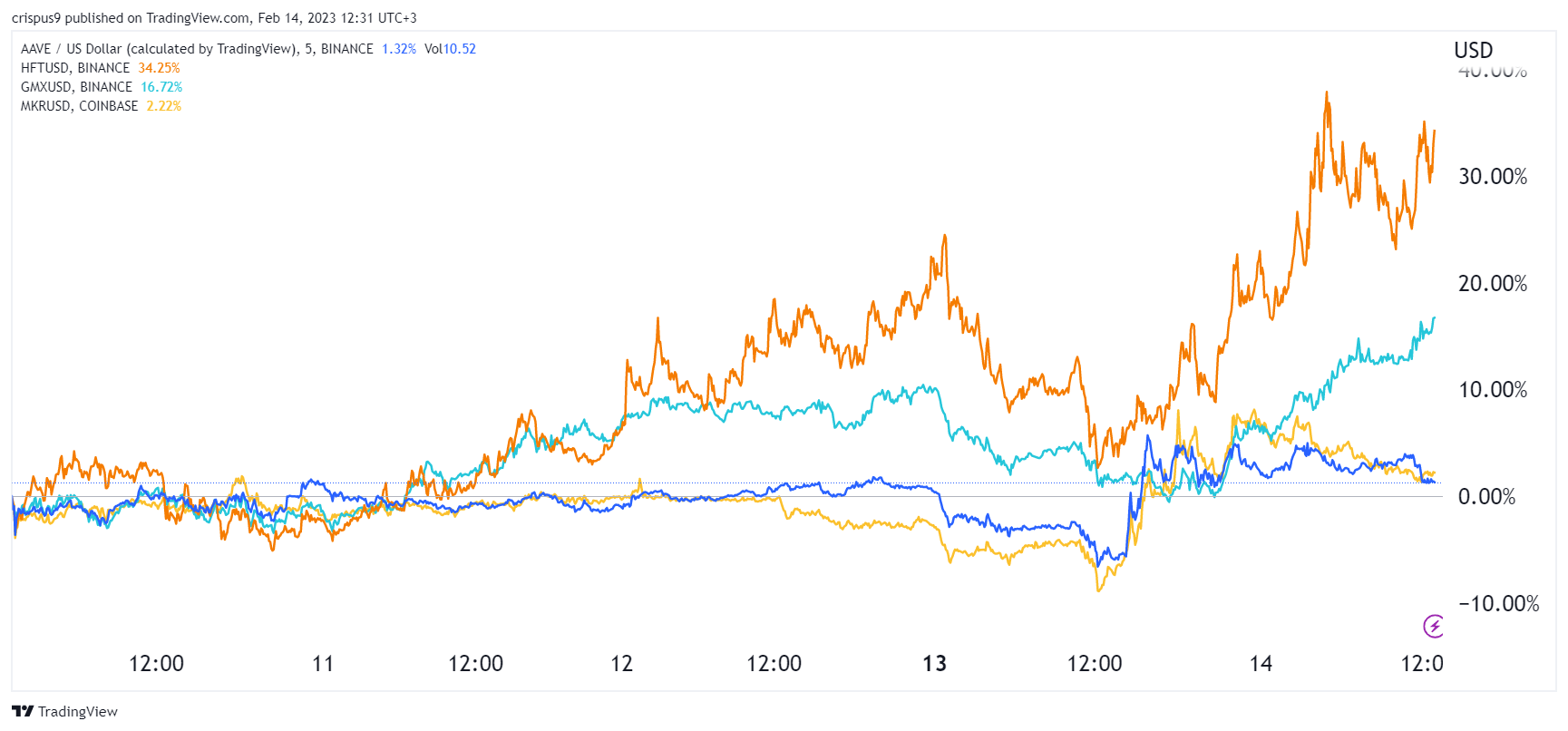

- DeFi tokens like Maker, Hashflow, and GMX are soaring.

Cryptocurrency prices were relatively mixed on Tuesday as focus remained on the upcoming American consumer price index (CPI) data. BNB coin price continued its sell-off amid concerns about regulations after Paxos stopped minting BUSD. MATIC, SHIB, and SAND have crashed by over 3% in the past 24 hours while the total market cap of all cryptocurrencies is hanging at $1 trillion.

DeFi tokens are doing well

A closer look at the best-performing coins of the day shows that most of them are in the decentralized finance (DeFi) space. For example, Hashflow’s (HFT) price has jumped by over 27% in the past 24 hours.

For starters, Hashflow is an upcoming DEX that makes it possible for users to trade assets across multiple blockchains like Optimism, Polygon, Ethereum, and Avalanche. It handled ove $27 million worth of tokens in the past 24 hours and over $145 million in the past 7 days.

Meanwhile, GMX price has risen by over 13% in the same period. GMX is a DEX that is relatively different from Hashflow. It is a platform that makes it possible for users to trade perpetual futures contracts and other assets. The blockchain operates in Avalanche and Arbitrum networks.

Another top DEX that is doing well is CRV, the native token for the Curve DAO ecosystem. CRV price has soared by 12% as inflows in the ecosystem rise. Further, other DeFi tokens like AAVE, Maker’s MKR, and Lido DAO have risen by over 5%. Other tokens associated with DeFi like Synthetix (SNX), 1Inch Network, and Convex Finance are doing well.

Read more: How to buy AAVE.

Regulatory concerns remain

DeFi token prices have done well despite the rising concerns about regulations. The biggest crypto news of the week is that Paxos was ordered to stop minting new Binance USD stablecoins. In a statement, Paxos said that it will sue the department and argue that BUSD was not a financial security.

According to Bloomberg, New York authorities were alerted about Paxos by Circle, the creator of USD Coin. Circle accused Paxos of mismanaging reserves that back Binance USD. In a statement, the department said:

“Paxos failed to address key deficiencies, requiring further Department action, ordering Paxos to cease minting Paxos-issued BUSD. The Department is monitoring Paxos closely to verify that the company can facilitate redemptions in an orderly fashion.”

Therefore, maybe DeFi tokens are rising because BUSD has limited uses in DeFi like Tether and Circle’s USDC coin.