- The iShares 20+ Treasury Bond ETF (TLT) has plunged to 2014 lows.

- QQQ and SPY ETFs are approaching their correction zone as the sell-off intensifies.

- Bitcoin, Tron, and Chainlik prices have held well during the sell-off.

Bitcoin, Tron, and Chainlink prices have done well in the past two weeks. Chainlink, the biggest oracle in the blockchain industry, rose to a high of $7.57, the highest level since August 14. It has jumped by more than 30% from the lowest level this month.

Tron, the cryptocurrency started by Justin Sun, surged to a high of $0.085, the highest point since July 28th. It has climbed by over 20% from the lowest point in August. As I wrote on Tuesday, Tron’s rally has been helped by the strong inflows in JustLend, the biggest DeFi protocol in its ecosystem.

Bitcoin, the biggest cryptocurrency in the world, has remained steadily above $26,000. It is much higher than this month’s low of $24,800. I believe that this price action is mostly because of the rising hope that the SEC will approve a spot Bitcoin ETF in the coming months.

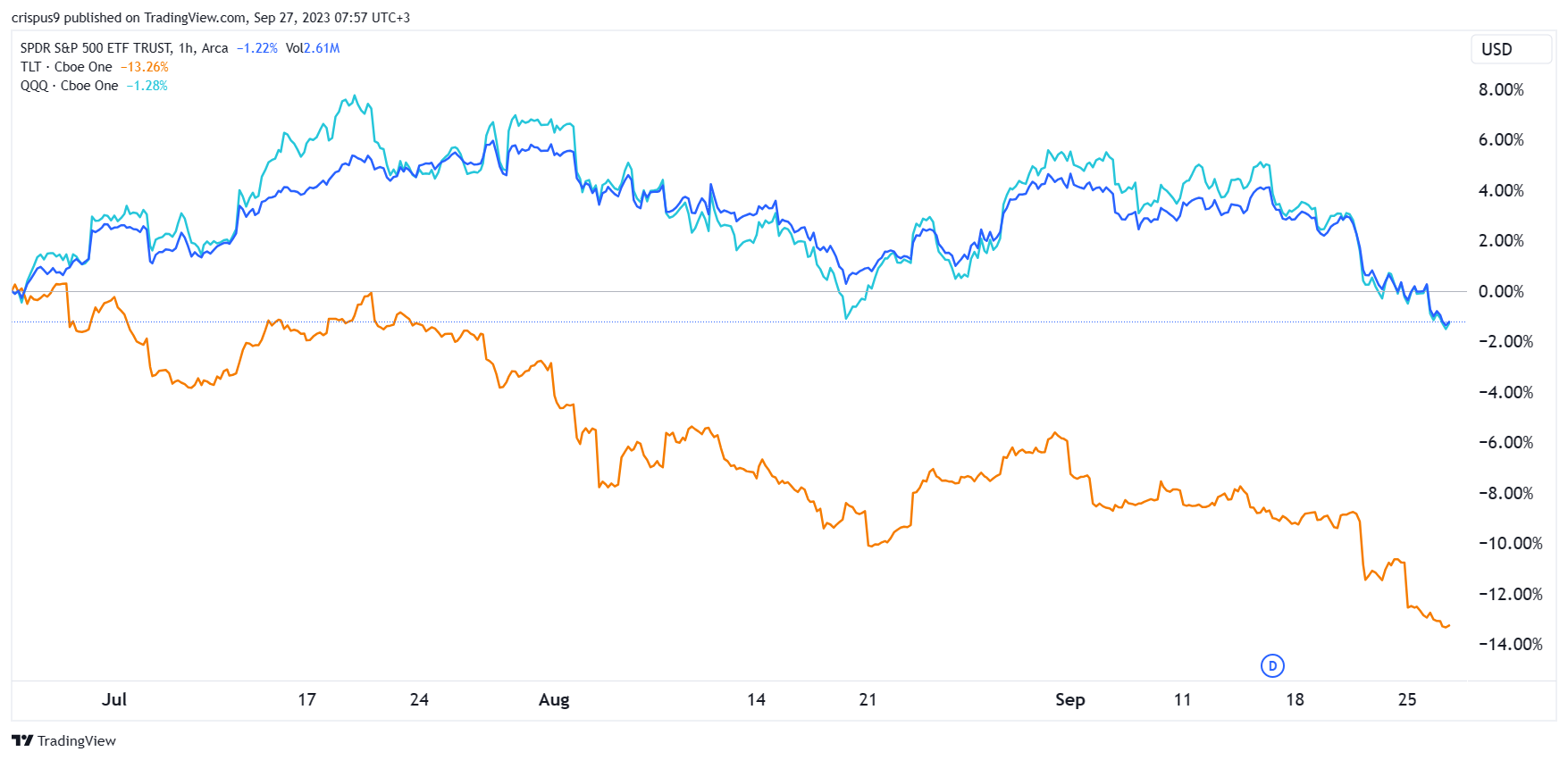

Bitcoin, Tron, and Chainlink price action has deviated from that of key Exchange Traded Funds (ETFs). The iShares 20+ Treasury Bond ETF (ETF) has plunged to $88.95, the lowest level since July 2014. It has crashed by more than 46% from the highest point in 2020.

TLT is an important ETF since it tracks Treasury Bonds with 20%+ maturities. It has crashed as bond yields have jumped in the past few months. The 30-year bond yield has jumped to 4.5%, the highest point in more than a decade.

Meanwhile, Invesco QQQ ETF (QQQ) has dropped by over 8% from the highest point this year. QQQ is an important fund that tracks the biggest technology companies in the United States. Its biggest constituents are companies like Microsoft, Apple, Nvidia, and Tesla. QQQ has formed a double-top pattern on the weekly chart pointing to more downside.

The SPDR S&P 500 (SPY) ETF has also been in a strong bearish trend. It dropped to $423 on Tuesday, 7% below the highest point this year.

TLT, SPY, and QQQ ETFs have crashed as investors react to numerous headwinds like the hawkish Federal Reserve, the ongoing UAW strike, rising consumer inflation in the US, government shutdown risks, and the slowing Chinese economy.

Historically, Bitcoin, Tron, and Chainlink prices tend to move in the same direction as these ETFs. Therefore, there is a likelihood that fear in the market will spread to the crypto industry soon.