- Gold price has risen to the important resistance level at $2,000.

- Bitcoin and other cryptocurrencies like Ether, XRP, and Litecoin have also surged.

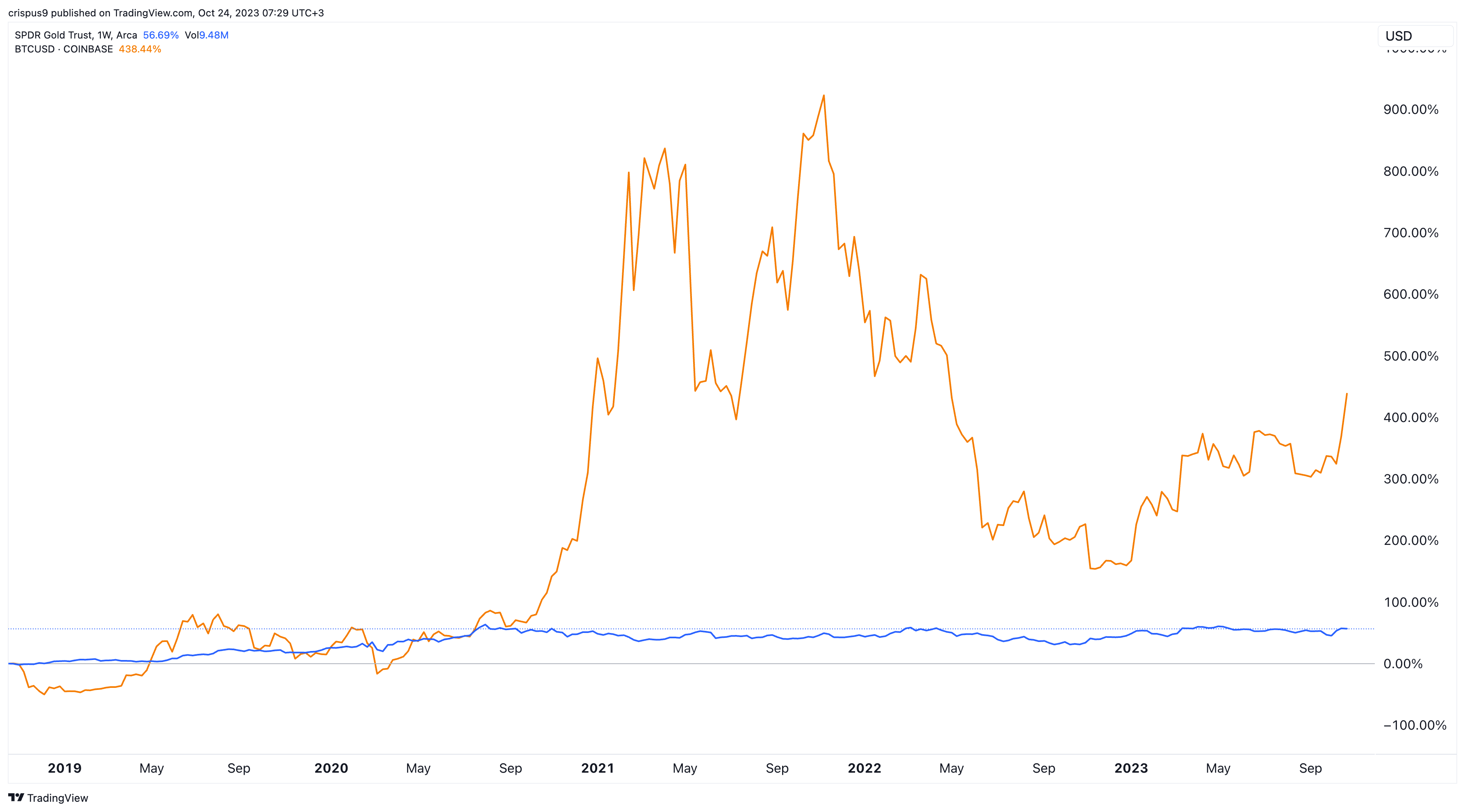

- Bitcoin assets seem to be better investments than gold and GLD ETF.

Gold price has done well in the past few days. The precious metal jumped to the crucial resistance level at $2,000 for the first time since July last year. As a result, the SPDR Gold Trust (GLD) ETF has made a bullish breakout and is trading at $182.98. It has jumped by more than 8.9% from the lowest level this month.

Gold and GLD ETFs have risen

Gold and GLD ETF have jumped as concerns about the American economy continues. Data published by the American government showed that the country’s budget deficit widened to almost $2 trillion in the last financial year. Tax incomes crashed as the stock market retreat led to lower capital gains taxes.

At the same time, the cost to service the debt jumped as interest rates rose. The US spent over $800 billion to pay back the debt. The situation is set to worsen since the government debt has jumped to over $33.5 trillion while the Fed has pointed to more rate hikes in the future.

While the US borrowing is rising, traditional buyers of these treasuries are selling. China has dumped over $500 billion worth of US debt in the past few years. Similarly, Japan and Saudi Arabia have exited some of their positions. This means that the rising debt will need to have more interest as risks rise.

At the same time, gold supply is dropping while key central banks are boosting the accumulation. China, Russia, and Turkey have all bought gold as a way of hedging against the US dollar.

Therefore, the case for investing in gold and GLD ETF has never been higher. Inflation is rising, interest rates are at their highest level in two decades, while geopolitical risks have remained elevated.

Bitcoin is a better investment

However, I believe that gold investors should invest in Bitcoin, Grayscale Bitcoin Trust, BITO, and even MicroStrategy. For one, Bitcoin has proven that it can survive recessions as we saw during the Covid-19 pandemic.

Bitcoin is also doing well during the period of high-interest rates. It has jumped by more than 100% from its lowest level in 2022, which happened after the FTX collapse.

Most importantly, Bitcoin has thrived other black swan events in the crypto industry like the collapse of FTX, Voyager Digital, Terra Luna, and Three Arrows Capital. At the time, most people thought that the coin would not survive in the long term.

Most importantly, Bitcoin, which is seen as digital gold, has outperformed gold and GLD ETF since inception. It is also beating them this year as it has jumped by over 70% in the past 12 months while gold has jumped by just 20%. In the past five years, Bitcoin has soared by almost 500% while gold is up by 55%.

Therefore, while investing in gold makes sense, it seems like buying Bitcoin, BITO ETF, and GBTC is a better deal.