Bitcoin price has stalled recently as the recent bullish momentum faded. The BTC coin was trading at $51,000 on Monday morning, where it has been stuck at in the past few weeks. This price is about $2,000 below its highest point this year.

GBTC outflows are continuing

Bitcoin price has done well this year as investors cheer the ongoing ETF inflows, which have led to more demand at a time when supply is expected to slow. BTC’s supply in exchanges has remained at a relatively low level recently.

There are signs that inflows in Bitcoin ETFs is slowing, which explains why the price has stalled in the past few days.

It is worth noting that one reason why the biggest ETFs have had robust inflows is that many investors were moving from the Grayscale Bitcoin Trust (GBTC). As I have written before, there is no reason for investing in GBTC, which has an expense ratio of 1.50%.

Data by ETF.com shows that the GBTC ETF has had over $7.2 billion in outflows this year. Last week’s outflows stood at over $486 million a decline from the previous week’s $586 million. The biggest weekly outflows stood at over $2.6 billion.

ARKB, FBTC, and IBIT inflows slow

Meanwhile, Cathie Wood’s Ark 21Shares Bitcoin ETF (ARKB) has over $1.3 billion in inflows. It has added assets in all weeks after going public. Last week, inflows stood at over $178 million, a sharp decline from the previous month’s $401 million. This fund has gained assets as investors cheer its lower fees compared to its peers. According to its offer, it charged no fee until it hit $1 billion in assets.

The Fidelity Wise Origin Bitcoin Fund (FBTC) has gained over $2.2 billion in assets this year. Recently, however, the pace of these increases has been a bit slow. The fund added $240 million last week, lower than the $720 million that it added in the other week.

The iShares Bitcoin Trust (IBTC) ETF added $442 million last week after adding $1.7 billion a week earlier. It now has over $6 billion in assets.

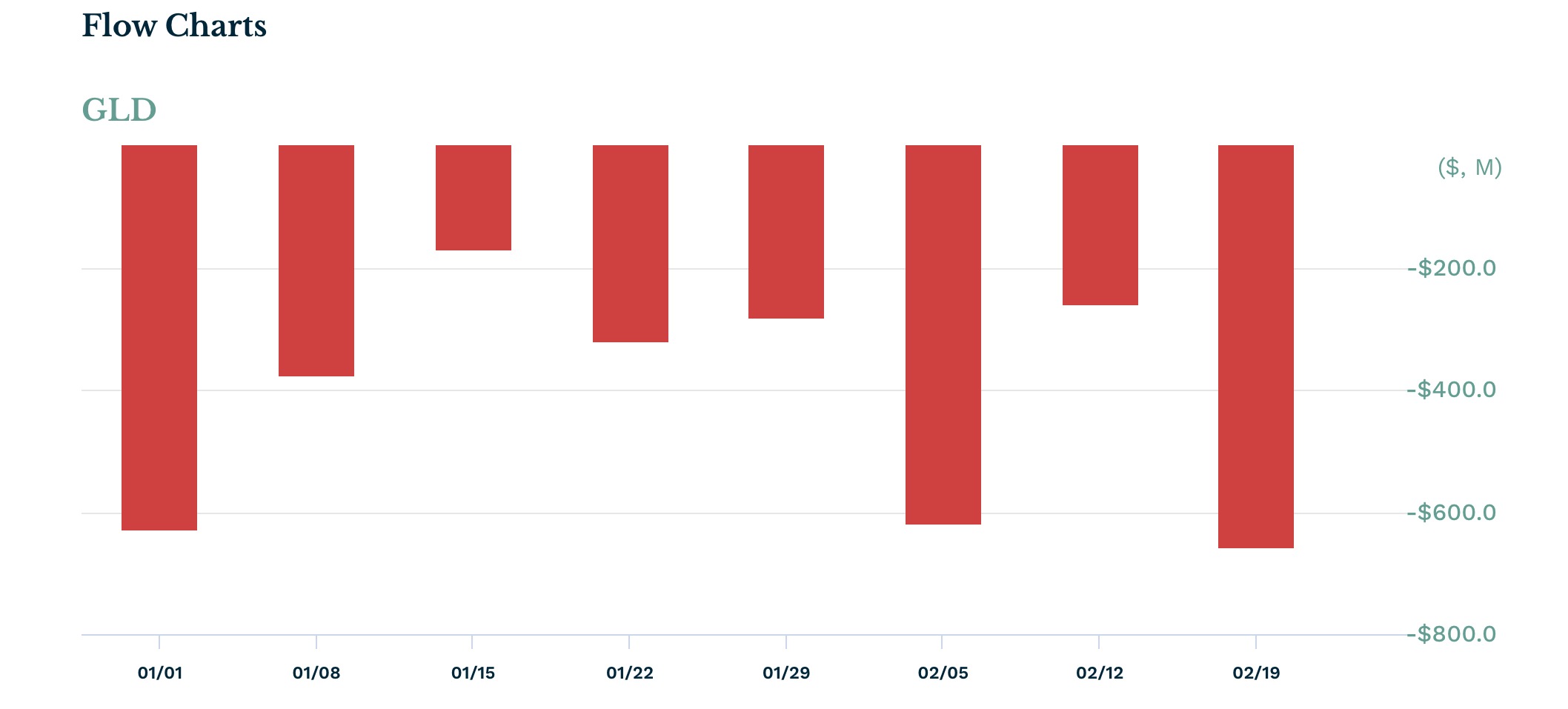

It is also worth noting that, as shown below, there are signs that many investors are moving from gold ETFs to Bitcoin funds. The chart shows that the SPDR Gold Trust (GLD) has had outflows in all weeks this year. It has shed over $3.3 billion in assets.

What next for Bitcoin ETFs?

The outlook for Bitcoin ETFs is still positive albeit inflows are expected to moderate in the coming months. This is a common situation where inflows jump shortly after launch and then slow after hitting a critical mass.

The future of these inflows will depend on the performance of Bitcoin, which most analysts believe is positive. For one, the coin has formed a bullish flag, which is one of the most popular signs in the financial market.

Further, Bitcoin halving is coming up. Halving is a situation where the number of rewards is slashed into half, making Bitcoin rare. In most cases, Bitcoin tends to do well ahead and after halving. A look at its history shows that it has always been higher in all its halving events.

In an interview last week, Tom Lee, the head of FundStrat noted that he was optimistic that BTC would jump to $150,000 this year. Analysts at Standard Chartered see it reaching $100k. In my view, I suspect that Bitcoin will retest its all-time high of $69,000.